At Facebook, Mark Zuckerberg moves to tighten the gag on shareholders — and no one can stop him

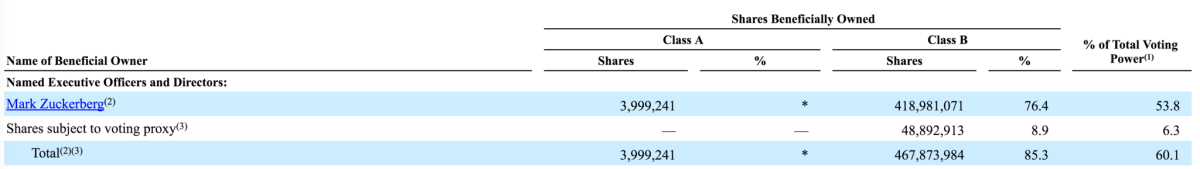

No one would ever mistake Facebook for a shareholder-friendly company. From the moment of its initial public offering in May 2012, it's been entirely under the control of its co-founder, chairman and CEO, Mark Zuckerberg. Thanks to a two-class stock structure in which Zuckerberg held impregnable control over shares with super-voting rights, he owned 28% of all outstanding shares but 57% of all shareholder votes.

Now he owns or controls even less of the company -- about 16% -- and fully 60.1% of the votes; he owns or controls barely any Class A shares, which get a measly one vote each, but 85.3% of the Class B shares, which get 10 votes each.

The board believes that a large part of Facebooks success has stemmed from the leadership, creative vision and management of Mark Zuckerberg, and that the companys future success will depend on Marks continued leadership.

— Facebook statement on third class of stock

But that's not enough. Facebook announced Wednesday that it plans to issue a third class of shares, Class C, that will have zero votes. The purpose is to allow Zuckerberg and his wife, Priscilla Chan, to pursue the dream of giving 99% of their shares to charity, without losing an iota of his voting control. Shareholders will have to vote on the arrangement, but because non-Zuckerberg voting power already is a joke, we can assume it will pass.

To hear Facebook (and Zuckerberg) talk, this is all to the great benefit of the shareholders.

"The board believes that a large part of Facebook’s success has stemmed from the leadership, creative vision and management of Mark Zuckerberg, and that the company’s future success will depend on Mark’s continued leadership," reads a statement on the company's website attributed to general counsel Colin Stretch. The new structure, he wrote, has the virtue of "allowing the company to maintain focus on Mark’s long-term vision for Facebook [and] encouraging Mark to remain involved with Facebook in a leadership role." (Did he really need encouragement?)

Zuckerberg himself states candidly that "I’ll be able to keep founder control of Facebook so we can continue to build for the long term, and Priscilla and I will be able to give our money to fund important work sooner."

Facebook isn't the first company to issue two classes of shares in order to safeguard control by insiders. It's not even the first company to issue three classes of stock; Alphabet (the company formerly known as Google) created a third class of non-voting shares in 2014 so the company could issue shares to use as acquisition currency without eroding the voting power of co-founders Sergey Brin and Larry Page and Executive Chairman Eric Schmidt.

Zuckerberg & Co. certainly aren't pioneers in treating the concept of "shareholder democracy" as a cynical fantasy. Corporate shareholders in general have contributed to the devaluation of their rights by consistently failing to exercise them. In corporate America, a 30% vote against management is considered a huge shareholder victory, because it happens so rarely.

The New York Stock Exchange, which was once the guardian of shareholder rights (for part of its history, anyway) once stood foursquare against the dilution of shareholder authority via multiple classes of stock. After a similar trend emerged during the 1920s -- with consequences that don't need pointing out -- the Big Board imposed a blanket rule against listing non-voting shares. That lasted only from 1940 until 1956, when Ford Motor Co. announced an IPO that would maintain voting control for the Ford family. The exchange gave in, followed by the Securities and Exchange Commission, which had also tried to hold back the tide of self-interested and entrenched shareholdings.

Facebook signaled how lightly it respects the concept of shareholder rights by endowing its three-class scheme with a fatuous justifications. The company assured holders that the plan was vetted by three ostensibly independent outside directors -- venture investor Mark Andreessen, politico Erskine Bowles, and Susan Desmond-Hellmann, CEO of the Bill and Melinda Gates Foundation -- who gave it thumbs-up. But what do they care? Altogether, those three directors own about two-hundredths of 1% of Facebook shares. They're not likely to stand up for shareholder rights, because they're barely shareholders themselves.

Facebook says the Class C shares will have "the same economic rights as the existing Class A and Class B shares," but that's plainly untrue if one considers a vote fundamentally an economic right. The Facebook board has simply redefined the value of a shareholder vote out of existence.

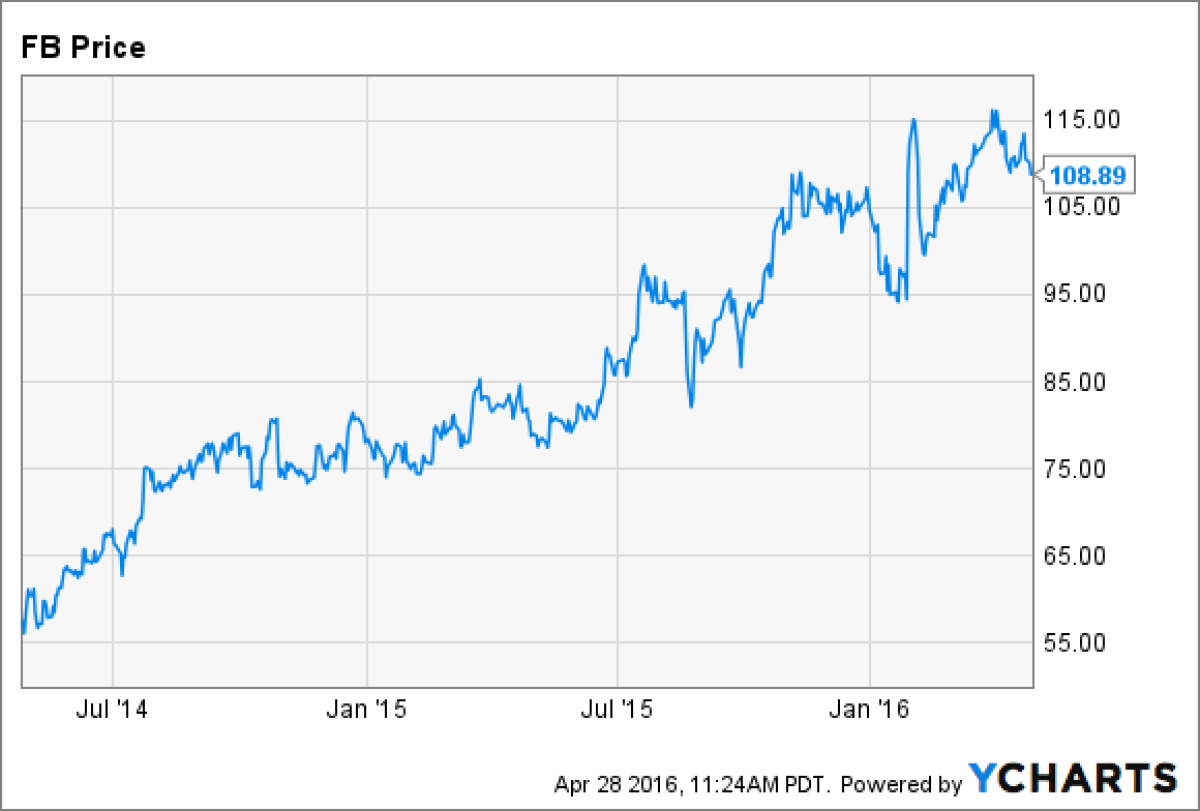

The company's judgment of the sheepleness of its shareholders evidently was well placed, because the existing shares soared after the announcement; as of this writing, the stock is reaching an all-time high of $117.75, up more than 8% on the day. Most of that rise was fueled by the company's gilt-edged report for the first quarter ended March 31 -- a 52% increase in revenue and tripling of net income over the same period a year ago.

Yet the effort to chisel Zuckerberg's control into stone has the flavor of an idea that looks great right up to the moment that it doesn't look at all good. The shareholders' marriage to Zuckerberg's vision and -- let's face it -- whims is hard to argue with as long as Facebook turns in results like this. But if the engine sputters, what then? As I advised shareholders in May 2012, just after the IPO, "[y]ou better hope he does everything right, because if he doesn't, he'll be harder to get rid of than tuberculosis."

Examples abound of founder-friendly share structures that have done nothing to make companies successful, especially in the tech sector. Among the youthful companies with near-impregnable insider control are Zynga, Groupon, and LinkedIn. Over the last two years, they've all woefully underperformed the overall stock market. But such companies aren't open to outside advice that might improve their prospects. The only choice shareholders have is to sell -- and that's what they do, with alacrity. Over the last two years, Zynga is down nearly 38%, Groupon about 34%, and LinkedIn about 20%. The Standard & Poor's 500 index is up 12%.

RELATED: How creating new Facebook stock will keep Mark Zuckerberg in control

Super-voting arrangements fundamentally display contempt for the very principle of public share ownership. If that's the attitude, the best way to ensure Mark Zuckerberg's permanent control of Facebook was to keep it private. Indeed, it was clear at the time of Facebook's IPO that it didn't need to go public to raise money, and did so only to meet regulatory rules mandating public financial disclosures once shares in a company become distributed widely enough. But the company could have found ways to avoid that outcome.

There's an adage in the venture capital world that public investors bring a company cheap money, but dumb money. Facebook seems determined to squeeze that notion until it screams for mercy. But does it have to show that it thinks its shareholders are that dumb?

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email michael.hiltzik@latimes.com

Return to Michael Hiltzik's blog.

MORE FROM MICHAEL HILTZIK

How free college tuition would become a giveaway to the rich

Healthcare shocker: These insurers are making money on Obamacare

Tribune Publishing Chairman Michael Ferro says Gannett is 'trying to steal the company'